-

Look after your health. Engage with AIA Vitality and earn AIA Vitality Points for completing health checks and staying active - and be rewarded for your healthier choices.

Look after your health. Engage with AIA Vitality and earn AIA Vitality Points for completing health checks and staying active - and be rewarded for your healthier choices. -

Earn 10,000 AIA Vitality Points and achieve AIA Vitality Silver Status by 31 December 2022.

-

Receive a refund benefit of 50% on the Extras premiums you’ve paid throughout 2022, minus any Extras claims you make during this period.

- OR -

-

Earn 20,000-30,000 AIA Vitality Points and achieve AIA Vitality Gold or Platinum Status by 31 December 2022.

-

Receive a refund benefit of 75% or 100% on the Extras premiums you’ve paid throughout 2022, minus any Extras claims you make during this period.

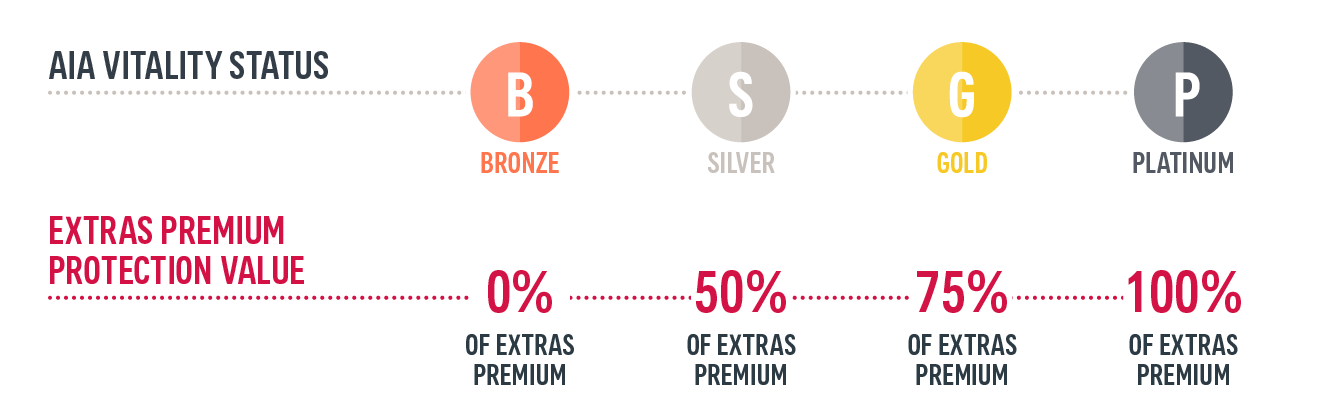

EXTRAS VALUE PROTECT EXPLAINED

Platinum status gives you 100% protection value

Gold status gives you 75% protection value

Silver status gives you 50% protection value

Bronze status doesn’t give you any protection value

BENEFIT CALCULATION – LET’S LOOK AT AN EXAMPLE

Jessie, an AIA Vitality member currently at Silver Status.

STILL HAVE QUESTIONS? YOU’LL FIND THE COMMON FAQS BELOW

As a result of ongoing COVID-19 challenges we acknowledge that getting the most out of your Extras may be difficult.

That’s why we originally created Extras Value Protect, a one-off benefit designed to protect the value of your Extras cover in 2020 by providing eligible policyholders with a refund on your Extras premiums paid between April to December 2020.

We’re bringing it back for a third year in 2022 as we understand the ongoing challenges of the pandemic. Like 2021 their will be an ongoing tie to the AIA Vitality program.

To be eligible for Extras Value Protect you must:

- As at 31 December 2022 held one of the following open AIA Health ancillary products known as Extras products (“eligible products”):

- Lite Extras

- Standard Extras

- Lifestyle Extras

- Enhanced Extras

- Lite Saver Extras

- Healthy Saver Extras

- Active Saver Extras

- Have made at least one premium payment on an active AIA Health Insurance combined (Hospital and Extras) policy from 1 January 2022 to 31 December 2022.

- Have your AIA Health policy paid up-to-date and not be in arrears.

- Have an AIA Vitality status of Silver or higher as at 31 December 2022.

- Have an active AIA Health Insurance policy at the time that the refund is issued (February 2023).

Your Extras Value Protect is calculated using the following 3 components:

- Your AIA Vitality Status (as at 31 Dec 2022) to determine your protection value percentage

- Total Extras Premiums you have paid (1 January to 31 Dec 2022)

- Total Extras Claims you have received for services/treatments provided during the period 1 January to 31 Dec 2022.

*Please note that if there are two members on the policy, the higher of the two AIA Vitality Statuses will be used for the calculation.

Please refer to table below to see how this is calculated based on your AIA Vitality Status:

| Protection Value | AIA Vitality Status as at 31 Dec 2022 |

|---|---|

| Not eligible for Extras Value Protect benefit | Bronze or no AIA Vitality |

| 50% of total Extras premiums paid less Extras claims | Silver |

| 75% of total Extras premiums paid less Extras claims | Gold |

100% of total Extras premiums paid less Extras claims |

Platinum |

Please note that where your total Extras claims have exceeded the ‘Protection Value’ percentage of the Extras premiums paid during the eligibility period, no refund will be paid.

If you are eligible for a refund, we will notify you by the end of February 2023, with the notification confirming when the refund will be paid by direct deposit into your bank account .

Please ensure your email and banking details are up-to-date by logging in to your member portal or calling our Member Service Team on 1800 943 010. You will not be able to receive the refund until these are updated.

No, Extras Value Protect was designed as a one-off benefit in 2020 to protect the value of your Extras. Based on customer feedback and the continuing COVID-19 challenges, AIA Health decided to run Extras Value Protect in 2021 and 2022.

There are many easy ways that you can earn AIA Vitality Points to increase your AIA Vitality Status. To find out how visit AIA Vitality.

If you have combined Hospital and Extras cover the refund will be based only on the Extras portion of your total health insurance premium – not on the Hospital component.

No, if your AIA Vitality Status is at Bronze or you don’t have an AIA Vitality membership, or where your total Extras claims have exceeded the ‘Value Protection’ percentage of the Extras premiums paid during the eligibility period, no refund will be paid. If your membership is not active or paid up-to date you will also not receive a refund.

Please refer to 'How is the Extras Value Protect refund calculated?' for further details.

Yes, we’ll include any Extras premiums for cover held between 1 January to 31 December 2022, regardless of whether the premium was paid in advance prior to 1 April 2022.